Home » Case Studies » PPC For Insurance Companies

PPC For Insurance Companies

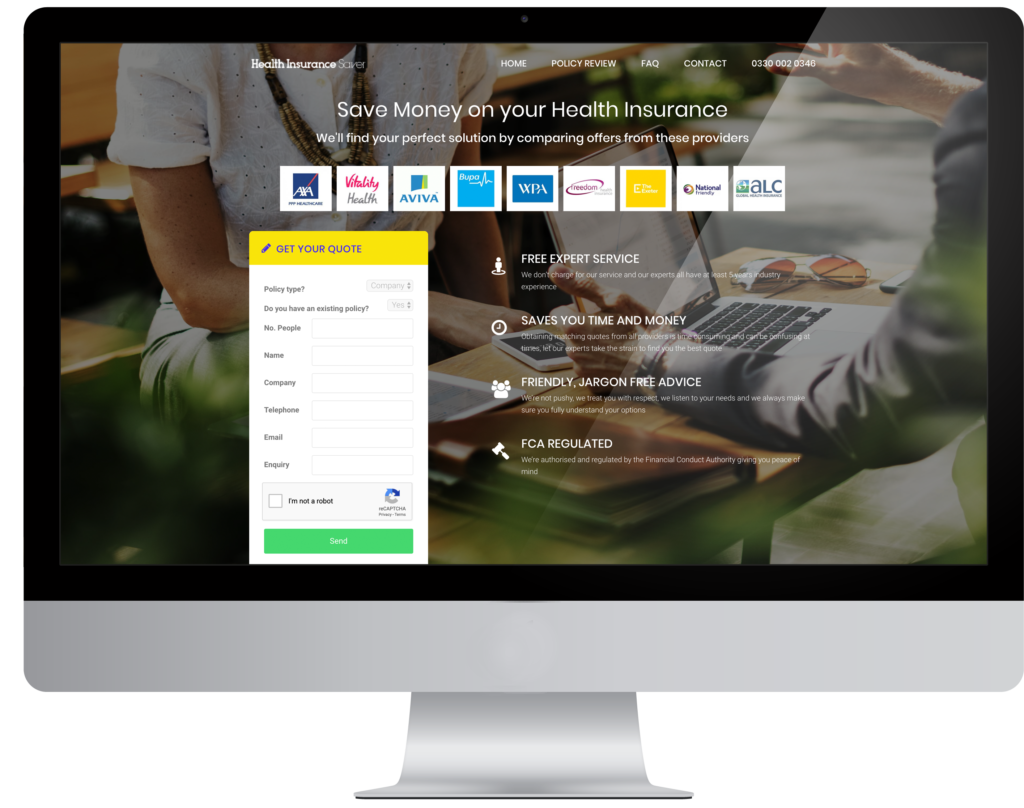

PPC for insurance companies can often result in high-spending, ineffectual campaigns, but not when managed correctly or with the PPC advice in this case study. Health Insurance Saver are specialists in the health and livelihood insurance sectors. Their practice is based on finding the best insurance deals for their clients with a focus on providing an excellent & personal customer service.

Brief

Health Insurance Saver are a long term client who we have worked with since they first started using PPC marketing as a lead generation source for their business. Originally the goal was to start getting enough leads to achieve a positive ROI, but since accomplishing that first goal, we’re now pushing on to increase the average amount of leads generated per month.

Strategy

Google Ads Management

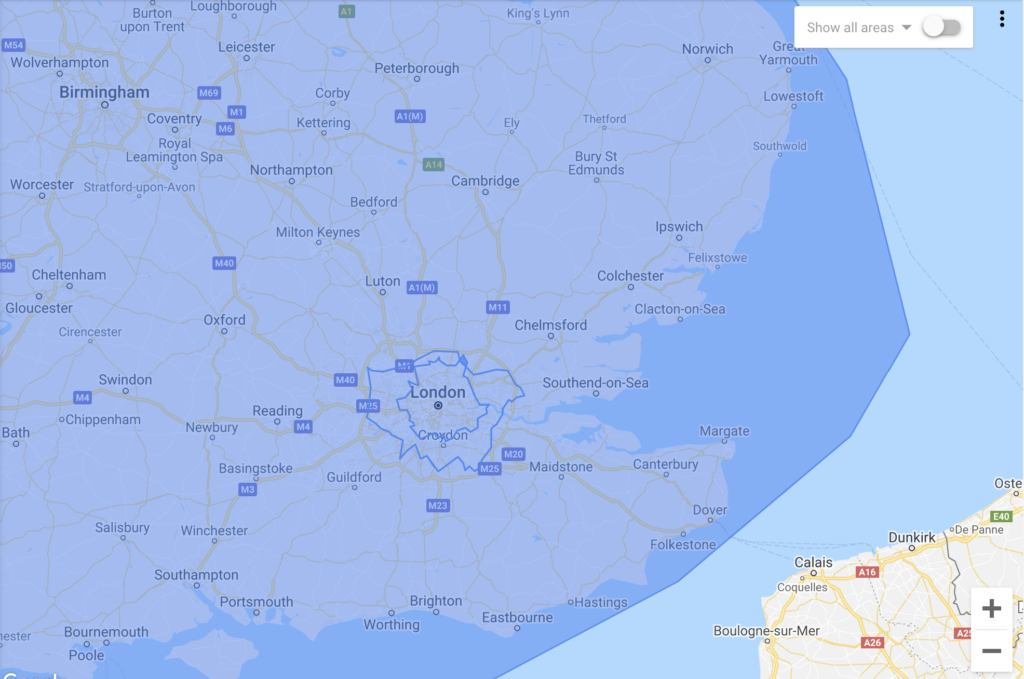

Our Google Ads approach in managing Health Insurance Saver has been to implement sustainable strategies that are based upon reliable performance data. We focus on highlighting our best performing keywords and the locations in which they are performing best within. This approach has allowed us to invest in keywords that bring the best results at a sustainable cost in comparison to the lead value generated.

We also encouraged a gradual increase in budget as we established a good conversion rate. The additional budget helped us to not be limited by budget and lose out on potential impressions. More impressions resulted in more clicks and therefore the higher likelihood of a conversion.

We also started to separate campaigns based on their goals and the types of products we wanted to generate leads for. We worked with Health Insurance Saver to help them develop location and product specific landing pages with website speed optimisations.

- Google Ads

Need help?

Tell us about your business. Let us get the best out of your PPC campaigns.

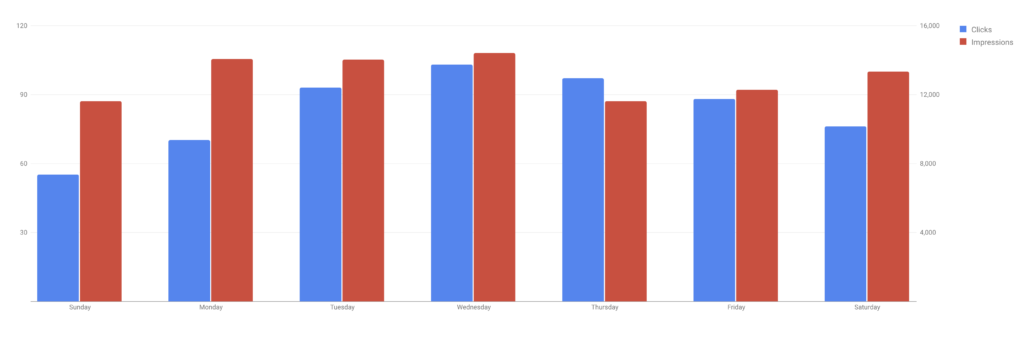

Performance Breakdown

It’s the simple Google Ads PPC management processes that are often the most effective. If you keep up to date with your housekeeping tasks, you’ll often find that your results will follow. It was important for us to evaluate the data available to gain insight into the peak periods of traffic. We could then take this data and implement ad scheduling and bid adjustments to more effectively bid when traffic was high or good quality. However, it is important to make sure this is reviewed frequently as data can often fluctuate.

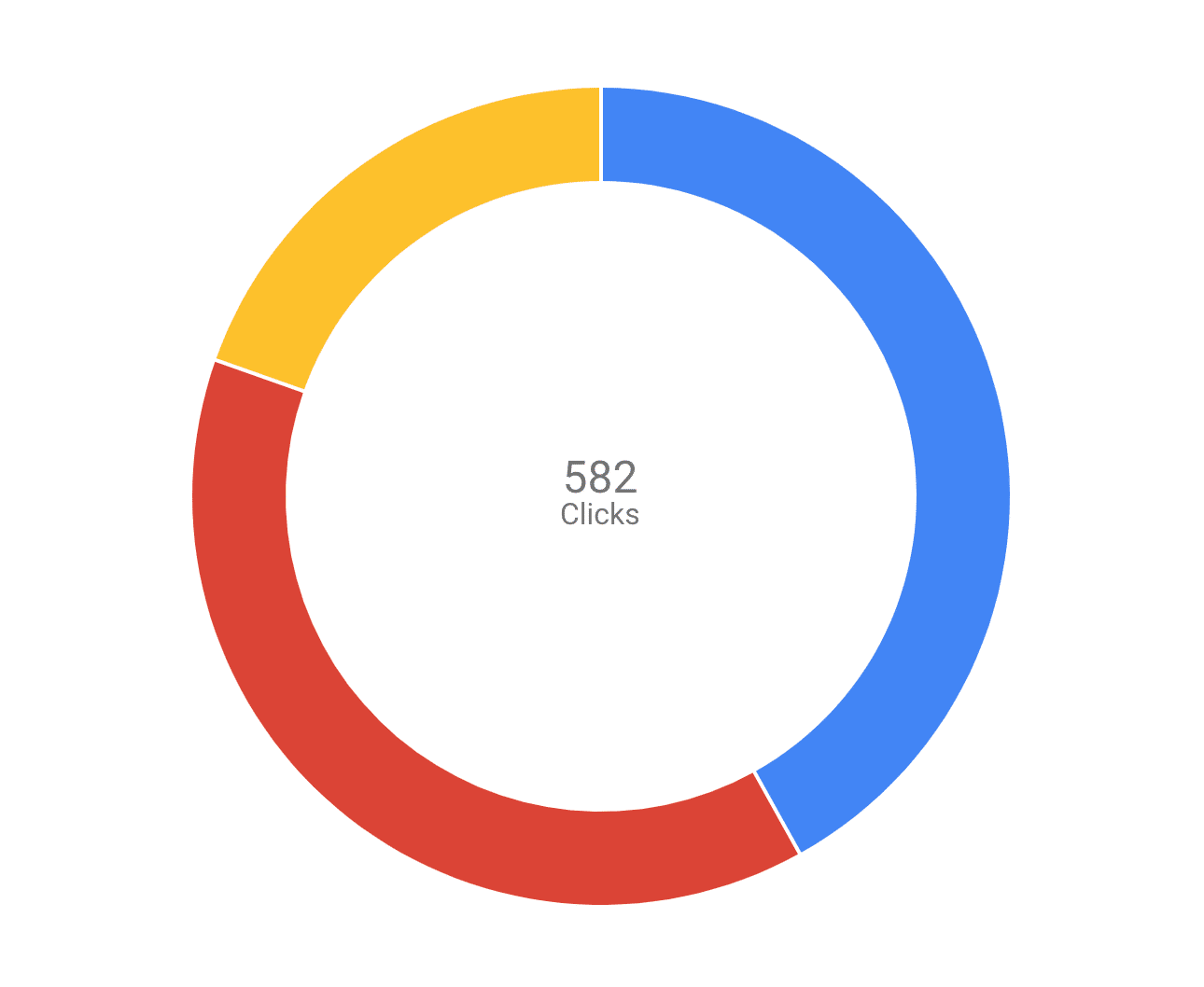

Device Breakdown

Another main area that is often overlooked is the device level analysis. It is important not to forget to check how the campaigns perform on each device. Key insights can be learned from checking the performance of desktop searches compared to mobile searches in your campaigns. For example, you may find out that your Desktop traffic has a much better conversion rate than your Mobile traffic. Therefore, you can implement a bid adjustment on your devices to take this data into account and optimise your Google Ads campaign accordingly. Combining this with other bid adjustments on different areas of your account can dramatically improve your overall account performance.

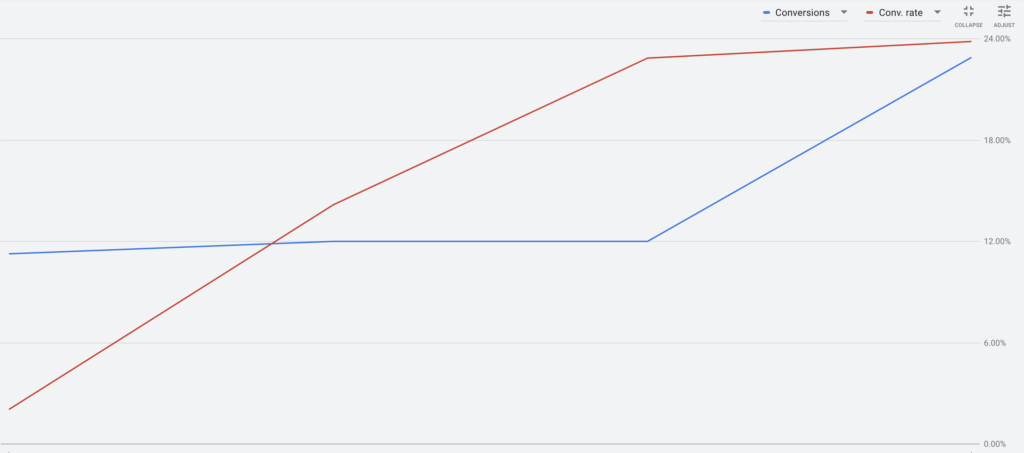

Results

The ongoing Google Ads management that we provide to Health Insurance Saver continues to provide outstanding results:

Conversions have increased by 384% YoY through conistent and simple day-to-day account management. This has also resulted in a 40% decrease in the cost-per-conversion as well as an overall increase in conversion rate of 56%.

By refining our targeted keywords and adding new keyword variations and match types we have been able to bid more effectively. This has helped us to also reduce the Avg. CPC by 47%.